International shipping has entered a structurally different regulatory era. What was once a gradual efficiency-driven policy landscape has evolved into a multi-layered carbon compliance regime with direct financial consequences, operational constraints, and long-term asset valuation implications.

In July 2023, the International Maritime Organization adopted its revised greenhouse gas strategy, formally committing international shipping to reach net-zero emissions by or around 2050, with interim checkpoints for 2030 and 2040. While the IMO framework establishes the global decarbonization trajectory, regional regulators have moved faster and further in introducing binding market-based measures.

The inclusion of maritime transport in the EU Emissions Trading System marks the first time international shipping faces direct carbon pricing at scale. From 2024 onward, ship operators calling at EU ports must surrender emission allowances based on verified CO₂ output, with coverage expanding from 40% in 2024 to full exposure by 2026. This mechanism transforms emissions from a technical metric into a balance sheet liability, directly linking operational decisions to cash flow and risk management.

Simultaneously, the FuelEU Maritime Regulation introduces a parallel compliance obligation beginning in 2025, targeting the greenhouse gas intensity of energy used on board. Unlike EU ETS, which prices emissions, FuelEU regulates fuel quality performance on a lifecycle basis. This creates structural incentives for alternative fuels, onshore power supply, and wind-assisted propulsion, while embedding penalty mechanisms for underperformance. Operators must now manage not only how much carbon they emit, but the carbon intensity of the energy they procure.

Overlaying these EU instruments is the Carbon Intensity Indicator (CII) regime under the IMO framework, which rates vessels annually from A to E based on operational efficiency relative to reference lines. A persistent D or E rating triggers mandatory corrective action plans and may influence charter attractiveness, financing terms, and long-term asset value.

Taken together, these frameworks do not operate independently. They interact operationally, financially, and strategically. A fuel switch that improves FuelEU compliance may affect EU ETS exposure. Speed optimization decisions that improve CII ratings may alter voyage economics. Allowance procurement strategies must account for evolving fuel pathways and trading patterns. Compliance is no longer a siloed reporting task—it is an integrated optimization problem spanning operations, finance, procurement, and commercial strategy.

Against this backdrop, shipping companies require systems that move beyond static reporting tools. They need platforms capable of continuously translating operational data into regulatory outcomes, financial exposure, and forward-looking risk indicators across multiple frameworks simultaneously.

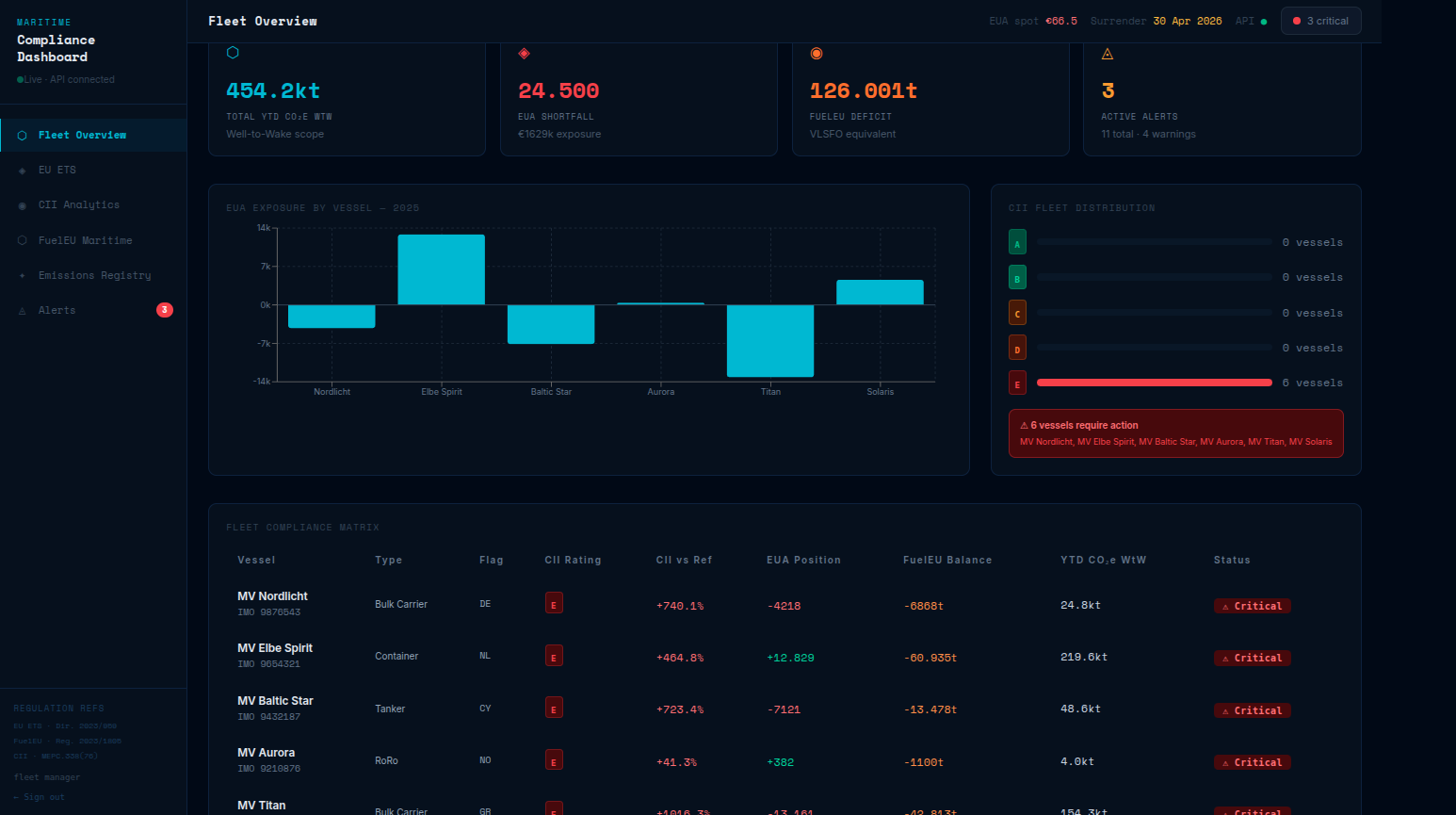

The Maritime Compliance Dashboard has been developed precisely for this new regulatory reality. It consolidates EU ETS, FuelEU Maritime, and CII obligations into a single analytical environment, enabling operators to quantify exposure, anticipate compliance gaps, and align operational decisions with regulatory and financial objectives in real time.

1. Real-Time Fleet Compliance Overview

The dashboard provides a consolidated compliance view across all applicable regulatory frameworks:

EU ETS Exposure:

Verified CO₂ emissions

Coverage classification by voyage type

EUA (European Union Allowance) requirements

Phase-in application (40% in 2024, 70% in 2025, 100% from 2026)

Mark-to-market financial exposure based on current EUA prices

Coverage logic:

Intra-EU voyages → 100% of emissions covered

EU ↔ non-EU voyages → 50% of emissions covered

Non-EU ↔ non-EU voyages → 0% covered

At berth in EU ports → 100% covered

FuelEU Maritime Compliance:

Well-to-wake GHG intensity (gCO₂e/MJ)

Annual reduction target tracking (2% from 2025 baseline)

Compliance balance (banking, borrowing, pooling)

Penalty exposure modelling

Onshore Power Supply (OPS) compliance

Wind-assisted propulsion reward factors

CII Ratings:

Annual Attained CII (AER-based)

Reference line comparison (per MEPC.339(76))

Rating bands A–E (per MEPC.338(76))

Projected end-of-year rating

Corrective action planning for D/E risk

Fleet-level aggregation enables compliance officers and management teams to assess exposure, risk, and capital requirements across the entire portfolio.

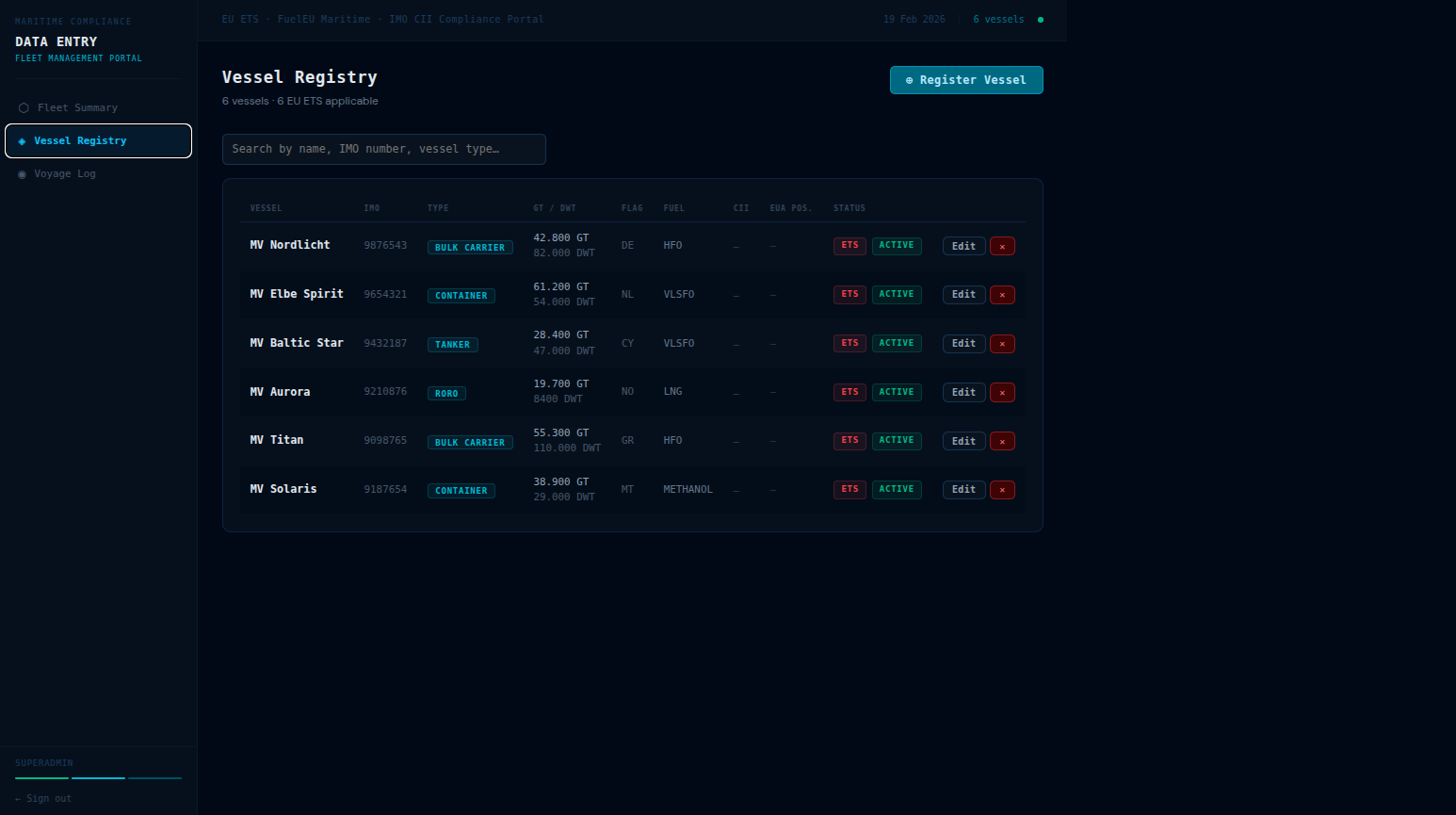

2. Vessel-Level Compliance Profile

Each vessel includes a dedicated compliance workspace featuring:

Annual emissions history (from 2023 onward)

ETS-classified voyage log with automated coverage allocation

Fuel consumption records (BDNs, noon reports, flow meters)

Verified MRV data alignment

CII historical ratings and forward projections

FuelEU annual compliance balance

Credit tracking (OPS, wind, pooling)

All data is structured to support verifier-ready documentation and audit trails.

3. Intelligent Voyage Management

The system automatically evaluates each voyage against all applicable frameworks.

For EU ETS:

Dynamic classification based on port pairings

Automatic 100% / 50% / 0% coverage allocation

Berth emissions inclusion

Real-time EUA requirement calculation

For FuelEU:

Energy mix analysis

Lifecycle emission factor application

Voyage contribution to annual intensity

For CII:

Distance, cargo proxy, and fuel inputs

Continuous AER impact monitoring

Voyage completion triggers synchronized recalculation across all regulatory layers, ensuring up-to-date compliance positioning.

4. Advanced Regulatory Calculation Engine

The backend architecture exposes stateless calculation services implementing:

EU ETS:

CO₂ emissions using IMO emission factors

Phase-in schedule logic

EUA requirement computation

Exposure modelling based on EUA price scenarios

FuelEU Maritime:

Well-to-wake GHG intensity calculation

Annual limit comparison

Banking, borrowing, and pooling logic

Penalty projections as defined in regulation

CII:

AER computation methodology

Vessel-type reference line modelling

Rating band allocation

Multi-year trajectory simulation

All calculation logic aligns with applicable IMO and EU regulatory texts and is version-controlled to accommodate future amendments.

5. Proactive Compliance Alerting

An embedded alert system continuously monitors regulatory risk indicators:

Critical Alerts:

EUA shortfall risk

Projected FuelEU penalty exposure

CII downgrade to D/E (projected or confirmed)

Warning Alerts:

D-rating trajectory risk

FuelEU compliance deficit trending

Phase-in escalation impact

Advisory Alerts:

Regulatory amendments

Reporting deadlines

Verification milestones

All alerts are traceable, assignable, and auditable to support internal governance processes.

Technical Architecture:

Backend: FastAPI + PostgreSQL

The backend is built on FastAPI for high-performance async operations, with SQLAlchemy ORM and PostgreSQL as the database:

maritime-backend/

├── app/

│ ├── main.py # FastAPI application

│ ├── core/ # Configuration & security

│ ├── models/ # SQLAlchemy ORM models

│ ├── schemas/ # Pydantic request/response

│ ├── calculations/ # Emissions calculation engine

│ ├── services/ # Business logic

│ └── api/v1/ # REST endpoints

├── migrations/ # Alembic DB migrations

└── tests/ # Test suiteKey Technical Features:

- JWT-based authentication

- Role-based access control (RBAC)

- Alembic database migrations

- Docker Compose deployment

- Seeded test data for rapid onboarding

Frontend: React + Recharts:

The dashboard frontend is built with React and uses Recharts for data visualization:

- Interactive line charts for emissions trends

- Bar charts for fleet comparisons

- Area charts for CII rating distributions

- Real-time data updates via REST API

API Design:

The REST API follows OpenAPI standards with full Swagger/ReDoc documentation:

/api/v1/auth/* # Authentication

/api/v1/fleet/* # Fleet-wide summaries

/api/v1/vessels/* # Vessel CRUD + emissions

/api/v1/voyages/* # Voyage management + fuel

/api/v1/calculations/* # Stateless calculation endpoints

/api/v1/alerts/* # Alert managementRegulatory Frameworks Supported:

1. EU Emissions Trading System (EU ETS):

- Voyages classified as intra-EU, extra-EU, or mixed

- Phase-in schedule: 40% (2024) → 100% (2026)

- Financial exposure calculation in EUR

- EUA position tracking (surplus/shortfall)

2. FuelEU Maritime:

- Annual GHG intensity limits (2% reduction in 2024, increasing annually)

- Multi-fuel support (conventional, biofuel, LNG, methanol, ammonia pathways)

- OPS (Onshore Power Supply) credits

- Wind-assisted navigation credits

- Penalty calculation for non-compliance

3. Carbon Intensity Indicator (CII):

- AER (Annual Energy Efficiency Ratio) calculation

- Rating bands: A (best) → E (worst)

- Reference lines per MEPC.339(76)

- Rating trajectory projections

- Improvement recommendations

Deployment Options:

Cloud Hosting

The dashboard can be deployed to any cloud platform:

- AWS, GCP, Azure, or DigitalOcean

- Docker Compose for single-server deployments

- Kubernetes for scalable, HA configurations

On-Premises

For operators requiring data sovereignty:

- Full on-premises deployment option

- Air-gapped network compatible

- Local database with encrypted storage

Conclusion:

With EU ETS, FuelEU Maritime, and CII requirements converging, compliance management is no longer a reporting exercise — it is a capital allocation and operational optimization challenge.

The Maritime Compliance Dashboard delivers:

Integrated multi-framework visibility

Automated regulatory calculations

Financial exposure modelling

Verifier-ready documentation

Predictive compliance analytics

It provides shipping companies with a single, defensible source of truth for navigating the evolving maritime decarbonization regime.