A Carbon Intensity Indicator (CII) gap analysis is not simply a compliance calculation; it is a structured forward-looking assessment of whether a vessel’s operational carbon intensity trajectory will remain within the required rating thresholds under the tightening framework of MARPOL Annex VI. Because CII ratings are dynamic and recalculated annually against progressively stricter reduction factors, a static review of historical performance is insufficient. A proper gap analysis must evaluate both present compliance status and projected deterioration risk under future regulatory tightening.

Under the framework established by MARPOL Annex VI and administered by the International Maritime Organization, ships of 5,000 gross tonnage and above engaged in international voyages must calculate and report their attained annual operational carbon intensity. This is commonly expressed using the Annual Efficiency Ratio (AER), which measures grams of CO₂ emitted per unit of transport work, typically deadweight tonnage multiplied by nautical miles travelled. Each vessel’s attained value is then compared against a required CII value derived from a reference line anchored to 2019 performance and adjusted annually by a prescribed reduction factor.

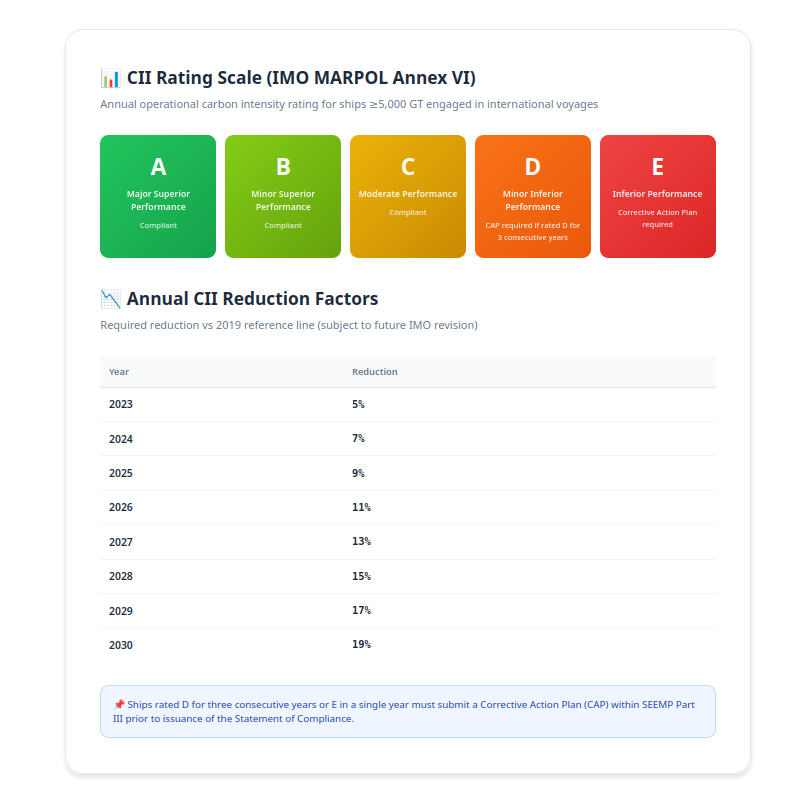

A CII gap analysis therefore begins with a precise reconstruction of the vessel’s historical operational carbon intensity profile. This requires verified fuel consumption data, voyage distance, cargo mass or equivalent transport work metrics, and confirmation that data collection aligns with IMO Data Collection System requirements. Historical trends must be examined not only to determine the most recent rating—A, B, C, D, or E—but also to understand variability drivers such as seasonal trade patterns, ballast ratios, port congestion delays, speed adjustments, and weather routing impacts. Variability analysis is essential because CII is operationally sensitive; a vessel with stable technical condition may still experience rating volatility due to commercial deployment.

Once the historical attained CII values are confirmed, the next step in a comprehensive gap analysis is to overlay the annual reduction trajectory established by IMO. These reduction factors, which progressively tighten required performance levels relative to the 2019 reference line, effectively compress the margin between attained and required carbon intensity each year. Even if a vessel’s actual emissions profile remains unchanged, its rating can deteriorate purely because the regulatory threshold has shifted. A robust analysis must therefore simulate required CII values for at least a three-to-five-year forward horizon, incorporating both regulatory tightening and operational assumptions.

The “gap” itself is the quantitative difference between the vessel’s projected attained CII and the required CII threshold for a given year. This gap may be expressed as an absolute difference in grams CO₂ per transport work unit or as a percentage variance. A negative gap indicates compliance margin; a positive gap indicates projected non-compliance. However, interpretation must go further than a binary compliant/non-compliant outcome. Because a rating of D for three consecutive years triggers a mandatory Corrective Action Plan (CAP), and a single E rating triggers immediate CAP inclusion within the Ship Energy Efficiency Management Plan (SEEMP Part III), the analysis must evaluate rating band probabilities, not just threshold crossing.

A sophisticated gap analysis therefore includes rating sensitivity modelling. This involves stress-testing scenarios such as marginal speed increases, cargo utilization decreases, extended ballast voyages, or hull fouling degradation. Each of these variables can materially shift the attained AER. For instance, a modest reduction in average cargo lift can worsen the AER significantly because the denominator of the intensity equation—transport work—declines while fuel consumption remains relatively stable. Similarly, increased port idle time inflates emissions without increasing transport work, worsening the ratio. These operational realities mean that commercial decisions and technical condition are deeply interlinked in CII performance.

Technical condition itself is another critical dimension of gap analysis. Hull resistance growth, propeller degradation, engine wear, and suboptimal trim can gradually increase fuel consumption per nautical mile. A vessel that was comfortably rated C in 2023 may migrate toward D territory by 2026 purely due to incremental efficiency loss combined with regulatory tightening. Therefore, engineering performance baselines and dry-docking schedules must be integrated into the forward model. Without that integration, the gap analysis risks underestimating deterioration risk.

An additional layer of complexity arises from strategic trade exposure. Vessels trading in high-speed liner services face structural challenges in maintaining favorable CII ratings, whereas vessels deployed in slow-steaming bulk trades may perform better operationally but still face margin compression as reduction factors tighten. Charterparty terms may restrict speed adjustments, limiting the owner’s ability to optimize performance. A credible gap analysis must therefore assess operational flexibility and contractual constraints, not merely technical efficiency.

The output of a thorough CII gap analysis should include a multi-year rating forecast under base-case and stress-case scenarios, identification of the year in which D or E risk becomes material, quantification of the emissions reduction required to restore C or above status, and an evaluation of the cost and feasibility of corrective measures. These measures may range from operational interventions such as speed optimization and voyage planning improvements, to technical retrofits including energy-saving devices, propeller upgrades, waste heat recovery systems, or even fuel switching strategies. Each potential measure should be evaluated for impact magnitude, implementation timeline, capital cost, and effect on other regulatory exposures such as carbon pricing under regional schemes.

Crucially, CII gap analysis must be positioned as a dynamic management tool rather than a one-time compliance check. Because ratings are recalculated annually and reduction factors are subject to potential revision under evolving IMO climate strategy discussions, the analysis should be refreshed at least annually and ideally integrated into fleet performance dashboards. It is not uncommon for vessels that appear compliant under current-year data to face a projected rating downgrade within two years if no corrective measures are undertaken.

In strategic terms, a well-executed CII gap analysis serves three functions simultaneously. It protects regulatory compliance by identifying CAP trigger risk early. It supports commercial positioning by enabling informed charter negotiations and deployment planning. And it informs capital allocation decisions by quantifying the economic justification for efficiency investments. In a regulatory environment where carbon intensity standards tighten annually and intersect with regional carbon pricing mechanisms, the ability to anticipate and manage rating deterioration is not merely a technical exercise but a core element of fleet value preservation.

Since 1 January 2023, applicable vessels must calculate and report their CII and receive a rating from A to E.

Ships rated D for three consecutive years or E in a single year are required to develop and implement a Corrective Action Plan (CAP).

The CII measures a vessel’s annual operational carbon intensity, expressed as grams of CO₂ emitted per transport work (typically grams CO₂ per dwt-nautical mile).

Applicable vessels:

≥5,000 GT

Engaged in international voyages

Specific ship types as defined by IMO

CII ratings:

A — Major superior performance

B — Minor superior performance

C — Moderate performance (compliant)

D — Minor inferior performance

E — Inferior performance

Annual Reduction Trajectory (vs 2019 Reference Line):

Reduction factors are subject to potential revision under the IMO 2023 GHG Strategy.

Compliance Timeline:

1 Jan–31 Dec: Data collection (calendar year)

By 31 March: Submit verified data to Flag Administration

By 31 May: Statement of Compliance issued

CAP must be included in SEEMP Part III and approved before issuance of Statement of Compliance where required.

Strategic Observations:

CII is operationally driven — speed, weather routing, cargo utilization, and port delays materially affect rating.

Aging vessels face structural disadvantage due to design baselines.

CII interacts with:

EU ETS

FuelEU Maritime

Charterparty performance clauses

IMO mid-term measures (carbon pricing / fuel standard) may materially reshape post-2027 economics.

What we do: We provide comprehensive CII gap analysis and CAP development services:

A. Current CII Assessment

- Historical CII calculation and verification

- Rating projection for current year

- Benchmarking against fleet type peers

B. Gap Analysis

- Identify performance shortfalls vs. required rating

- Quantify CO2 reduction needed

- Prioritize improvement measures by impact

C. Corrective Action Plan Development

- Short-term operational improvements

- Medium-term technical modifications

- Long-term strategic options

- Timeline and cost estimates for each measure

D. CAP Implementation Support

- Step-by-step implementation roadmap

- Monitoring and tracking framework

- Annual review and adjustment

Is your fleet prepared for the 2026 CII deadline?