The 2023 Revised Greenhouse Gas Strategy adopted by the International Maritime Organization represents the most significant policy shift in maritime climate regulation to date. While not itself a binding regulation, it establishes quantified levels of ambition that will guide the development of mandatory measures under MARPOL Annex VI over the coming decade.

The strategy signals a structural transformation of global shipping from fossil fuel dependence toward low- and zero-emission energy systems.

The IMO Strategy Framework

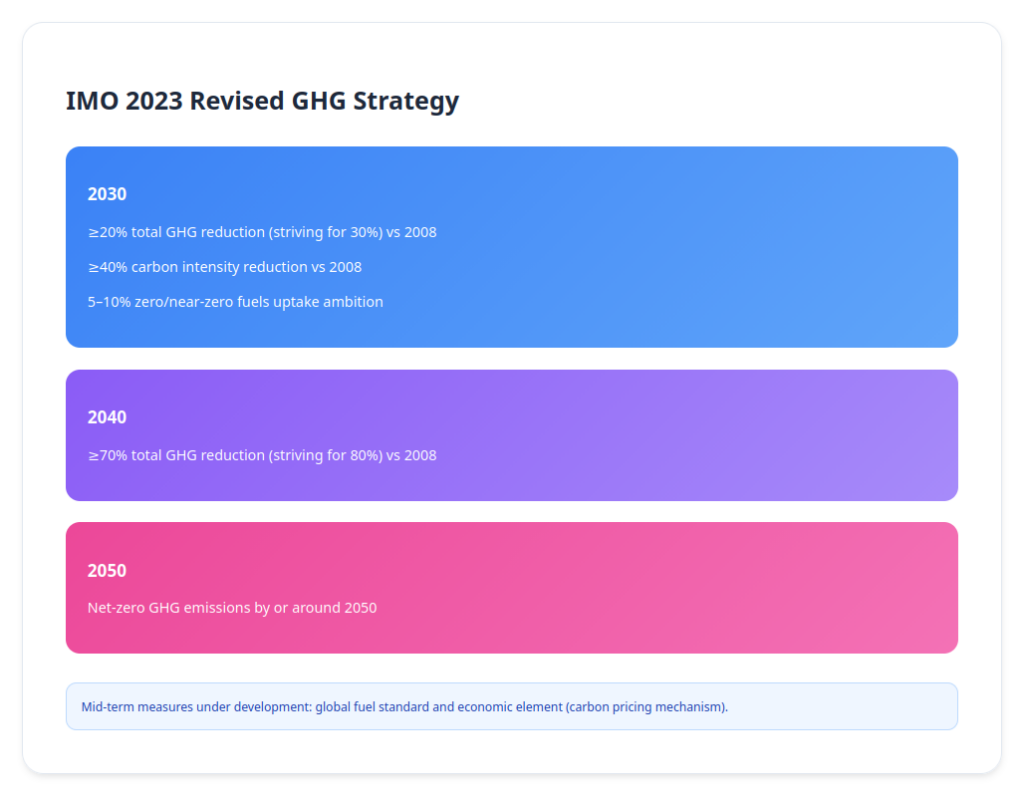

The Revised 2023 Strategy establishes three principal levels of ambition relative to 2008 emissions:

• Reduce total annual GHG emissions from international shipping by at least 20% by 2030, striving for 30%

• Reduce total annual GHG emissions by at least 70% by 2040, striving for 80%

• Achieve net-zero GHG emissions by or around 2050

In addition to absolute emissions reduction targets, the strategy maintains carbon intensity ambitions:

• Reduce carbon intensity of international shipping by at least 40% by 2030 compared to 2008

This distinction between absolute emissions and intensity is critical. Absolute targets require systemic fuel transition. Intensity improvements alone will not deliver net-zero.

The strategy also includes an ambition for uptake of zero- or near-zero GHG emission fuels, aiming for at least 5% (striving for 10%) of energy used by international shipping to come from such fuels by 2030.

From Strategy to Regulation

The IMO strategy does not automatically impose obligations. It mandates development of legally binding mid-term measures under MARPOL Annex VI.

Current negotiations focus on two core instruments:

1. A global greenhouse gas fuel standard (GFS)

2. An economic element, likely in the form of carbon pricing or a levy mechanism

These measures are expected to be finalized mid-decade, with entry into force potentially around 2027–2028, subject to adoption timelines and ratification thresholds.

Lifecycle assessment (LCA) guidelines are being finalized to determine how fuel emissions are measured on a well-to-wake basis rather than tank-to-wake alone. This shift materially affects the comparative assessment of fuels such as LNG, ammonia, methanol, and hydrogen.

The Structural Challenge

The IMO targets require a transition that cannot be achieved through incremental efficiency improvements alone. Conventional efficiency measures such as hull optimization, slow steaming, and waste heat recovery contribute to intensity reduction but are insufficient for deep absolute decarbonization.

Achieving the 2040 and 2050 ambitions requires:

• Rapid deployment of scalable zero- or near-zero emission fuels

• Global fuel supply chain transformation

• New propulsion technologies

• Massive capital investment in newbuilds and retrofits

The global fleet renewal cycle alone makes timing critical. Vessels ordered today may still be trading in 2050.

Decarbonization Pathways

No single fuel solution currently dominates. Multiple pathways are being evaluated.

Ammonia is attractive because it contains no carbon at combustion. However, it presents toxicity risks, combustion challenges, and infrastructure limitations. Engine technologies are advancing, but full commercial maturity remains in development.

Methanol offers easier handling characteristics and existing engine compatibility. However, unless produced from renewable feedstocks, it does not deliver full lifecycle decarbonization. Its lower energy density also requires larger fuel storage volumes.

Hydrogen represents a zero-carbon combustion fuel and is suitable for fuel cell applications, particularly in smaller vessels. However, storage challenges, energy density limitations, and infrastructure constraints limit near-term scalability for deep-sea shipping.

Battery-electric and hybrid systems are effective in short-sea and coastal applications, especially when combined with shore power. However, energy density constraints limit applicability for long-haul voyages.

Each pathway must be assessed under lifecycle emissions accounting, infrastructure availability, safety regulations, and capital cost implications.

Investment and Strategic Implications

The 2023 Strategy fundamentally alters long-term asset valuation. Ships with no pathway to zero-emission fuel compatibility may face accelerated obsolescence risk.

Key strategic considerations include:

• Dual-fuel newbuild design

• Retrofit optionality

• Fuel flexibility

• Charterparty carbon allocation clauses

• Access to green financing

Capital allocation decisions made between 2025 and 2035 will determine fleet viability in the 2040 regulatory environment.

What we do: We help shipping companies develop comprehensive decarbonization strategies:

A. Baseline Assessment

- Current emissions inventory

- Fleet carbon footprint analysis

- Regulatory exposure mapping

B. Pathway Analysis

- Technology options for your fleet

- Fuel transition roadmaps

- Cost-benefit analysis

C. Regulatory Preparation

- IMO strategy compliance planning

- MTMs impact assessment

- Horizon scanning for 2027+

D. Investment Strategy

- Newbuild vs. retrofit analysis

- Alternative fuel procurement

- Green financing options