A comprehensive European Union Emissions Trading System (EU ETS) analysis for maritime transport must extend well beyond a description of compliance mechanics. It is fundamentally a structured financial, regulatory, and operational exposure assessment. Unlike efficiency-based frameworks such as CII, EU ETS is a carbon pricing mechanism. It converts greenhouse gas emissions into a direct, monetized liability. Consequently, EU ETS analysis must be treated as balance-sheet risk management rather than regulatory reporting alone.

The maritime extension of the EU Emissions Trading System, adopted under the revised EU ETS Directive as part of the “Fit for 55” package, introduces shipping into the cap-and-trade carbon market framework. Under this system, a declining cap limits total allowable emissions across covered sectors. Companies must surrender emission allowances equal to their verified emissions. Allowances are tradable instruments whose market price fluctuates according to supply and demand dynamics within the EU carbon market. For maritime operators, this creates direct exposure to carbon price volatility.

An EU ETS analysis therefore begins with emissions quantification. Shipping companies must monitor, report, and verify greenhouse gas emissions in accordance with the amended EU MRV Regulation. As of 2024, CO₂ emissions are covered. From 2026 onward, methane (CH₄) and nitrous oxide (N₂O) are also included, expanding the scope of financial liability. Emissions subject to surrender obligations are defined geographically: one hundred percent of emissions from voyages between two EU ports, one hundred percent of emissions at berth in EU ports, and fifty percent of emissions from voyages between an EU port and a non-EU port. This partial geographical coverage introduces route-specific exposure complexity that must be modeled carefully.

A robust EU ETS analysis must first calculate the fleet’s historical verified emissions under EU-linked voyages. This requires segmentation of voyage data to distinguish intra-EU legs from extra-EU legs and allocation of emissions accordingly. The output is a verified emissions baseline expressed in tonnes of CO₂ equivalent. However, unlike static compliance frameworks, the financial burden depends not only on emission volume but on the market price of EU allowances (EUAs). Carbon price volatility has historically been significant, influenced by macroeconomic conditions, policy adjustments, energy market dynamics, and speculative trading behavior.

Therefore, an EU ETS exposure model must incorporate carbon price scenarios rather than assume a fixed value. Conservative modelling typically includes low, base, and high price scenarios across a forward time horizon. Each scenario is then applied to projected emission volumes to estimate annual allowance procurement cost. This cost must be analyzed relative to operating margins, charterparty terms, and fuel procurement strategies.

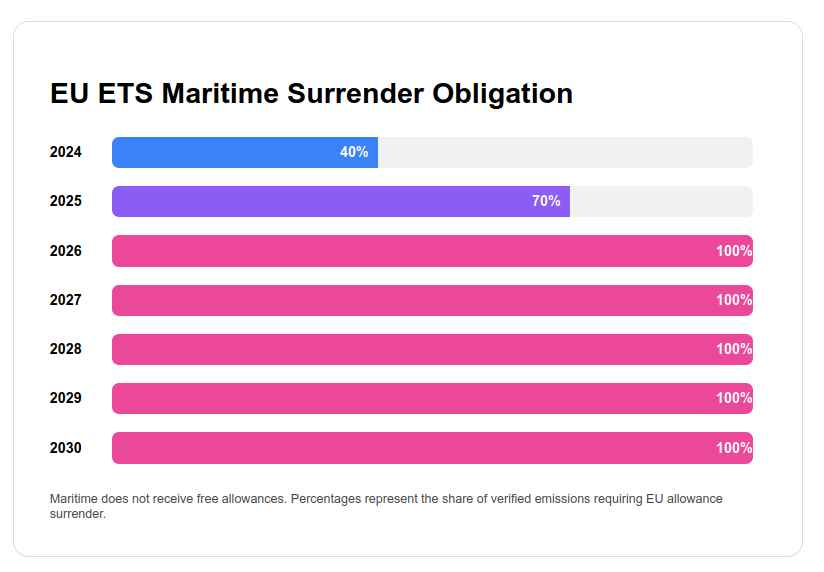

A distinctive feature of maritime inclusion is the phased surrender obligation. For 2024 emissions, shipping companies are required to surrender allowances corresponding to forty percent of verified emissions in 2025. This increases to seventy percent for 2025 emissions and reaches one hundred percent from 2026 onward. The phase-in reduces initial financial shock but should not be interpreted as a reduction in total exposure; it merely staggers full financial liability. An EU ETS analysis must therefore account for the ramp-up effect on cash flow.

Allowance procurement strategy is another core analytical component. Companies may purchase allowances on the spot market, hedge forward positions, or manage inventory to optimize timing. An analytical framework should examine the cost implications of different procurement strategies under volatile price conditions. Timing decisions can materially affect financial outcomes. For example, early procurement during periods of lower carbon prices may reduce long-term exposure, but it introduces capital allocation and liquidity considerations.

EU ETS analysis must also integrate operational variables. Fuel consumption patterns, vessel speed, port waiting times, and routing decisions all influence total emissions and therefore allowance liability. Unlike CII, which evaluates intensity, EU ETS is concerned with absolute emissions. Slow steaming reduces fuel burn and directly reduces carbon liability. However, speed reductions may affect charterparty obligations or fleet deployment schedules. Consequently, operational optimization must be evaluated against commercial constraints.

The interaction with other regulatory frameworks further complicates analysis. In EU waters, EU ETS overlaps geographically with FuelEU Maritime and, for certain vessels, with SOx and NOx ECAs. FuelEU Maritime imposes greenhouse gas intensity requirements on energy used onboard ships calling at EU ports, while EU ETS monetizes total emissions. A fuel switch that reduces lifecycle emissions may improve FuelEU compliance but may have limited immediate impact on EU ETS liability if combustion emissions remain substantial. Additionally, methane slip from LNG-fueled vessels becomes financially relevant once methane is included in EU ETS coverage. A comprehensive analysis must therefore examine fuel pathway implications across multiple regulatory regimes simultaneously.

Another analytical dimension involves charterparty cost allocation. The EU ETS Directive places legal responsibility on the “shipping company,” defined as the entity responsible for the ship’s operation under the ISM Code. However, commercial contracts often determine which party bears the economic burden of carbon costs. Time charter agreements may include EU ETS clauses allocating allowance costs to charterers proportionate to voyage exposure. Disputes or poorly drafted clauses can shift financial burden unexpectedly. An EU ETS risk assessment must therefore evaluate contractual exposure in addition to regulatory liability.

Financial modelling should also consider capital investment implications. Energy efficiency retrofits that reduce fuel consumption may yield measurable reductions in EU ETS cost. When carbon pricing is internalized into investment appraisal, the payback period of such retrofits can shorten significantly. Conversely, vessels with structurally high fuel consumption or limited remaining useful life may face declining competitiveness in EU-linked trades due to persistent carbon cost exposure. Therefore, EU ETS analysis becomes a tool for portfolio optimization and asset valuation.

Long-term analysis must also account for policy risk. The EU ETS cap declines annually, reducing total allowance supply. While shipping allowances are not allocated for free and must be purchased, overall tightening of the system may exert upward pressure on prices over time. Additionally, potential future reforms could alter allocation rules, inclusion thresholds, or maritime scope. Sensitivity analysis should therefore incorporate potential upward price trajectories and policy-driven volatility.

Cash flow timing is another critical consideration. Verified emissions reports must be submitted by 31 March each year, and the required allowances must be surrendered by 30 September. This creates a lag between operational emissions and financial settlement. Companies must plan liquidity accordingly. An EU ETS analysis should model annual cash flow cycles, incorporating both allowance procurement timing and surrender deadlines.

From a governance perspective, internal control systems must be evaluated. Accurate emissions monitoring under the EU MRV framework is foundational. Inaccurate data reporting can lead to penalties and enforcement actions. Therefore, the analytical framework must confirm that monitoring plans are approved, data collection processes are robust, and third-party verification procedures are reliable.

Strategically, EU ETS transforms carbon emissions from an externality into a quantifiable operating expense. It introduces market risk, regulatory risk, contractual risk, and operational risk simultaneously. Unlike static environmental regulations, it embeds maritime emissions within a dynamic financial market structure. The result is that carbon management becomes indistinguishable from financial risk management.

A thorough EU ETS analysis therefore encompasses emissions quantification, carbon price scenario modelling, procurement strategy evaluation, operational optimization modelling, contractual exposure review, capital expenditure sensitivity, liquidity planning, and policy trajectory assessment. It must be forward-looking, scenario-based, and integrated with broader fleet strategy.

The European Union Emissions Trading System (EU ETS) is the EU’s primary carbon pricing mechanism and a central pillar of the Fit for 55 climate framework. As of 2024, maritime transport is included in the EU ETS, requiring shipping companies to monitor, report, verify, and surrender allowances for greenhouse gas emissions.

Maritime inclusion is phased:

2024: 40% of verified emissions must be surrendered

2025: 70%

2026 onward: 100%

Failure to comply results in financial penalties and potential operational restrictions.

The EU ETS operates under a cap-and-trade framework. A declining emissions cap reduces total allowable emissions over time, while tradable allowances create a market-based carbon price signal.

For maritime operators, emissions compliance is now a financial exposure that must be actively managed — not merely reported.

The revised ETS Directive aligns with the EU target of –62% net GHG reduction by 2030 (vs 2005 levels for ETS sectors).

EU ETS maritime applies to:

Ships ≥5,000 gross tonnage carrying cargo or passengers for commercial purposes

100% of emissions from intra-EU voyages

50% of emissions from voyages between EU and non-EU ports

100% of emissions occurring at berth in EU ports

Covered greenhouse gases: CO₂ (from 2024) and CH₄ and N₂O (from 2026)

The legally responsible entity is the “shipping company” (shipowner or ISM operator).

The regulatory framework is governed by: The revised EU ETS Directive, The amended EU MRV Regulation (EU) 2015/757, and The Union Registry framework for allowance management.

What we do: We provide end-to-end EU ETS compliance and carbon exposure management for shipowners, operators, and managers.

A. Monitoring & Data Integrity

Monitoring Plan development and amendments

Fuel consumption validation

Voyage classification (intra-EU vs extra-EU)

GHG calculations in line with EU MRV methodology

B. Reporting & Registry Management

Annual emissions report preparation

Union Registry account setup and support

Documentation readiness for accredited verification bodies

C. Verification & Audit Readiness

Pre-verification compliance gap assessments

Technical liaison with accredited verifiers

Corrective action implementation

D. Carbon & Allowance Strategy

Emissions forecasting and exposure modelling

Budget impact analysis

Allowance procurement and timing strategy

Cost optimization aligned with fleet decarbonization plans

Strategic Considerations for Maritime Operators

EU ETS compliance should not be treated as an isolated reporting exercise. It intersects with broader regulatory and commercial risks:

FuelEU Maritime (a separate regulation) introduces fuel intensity requirements and penalty exposure beginning 2025.

Carbon price volatility introduces balance sheet risk.

Charterparty clauses must allocate ETS cost responsibility clearly.

Decarbonization investments now have measurable carbon price payback implications.

Operators who integrate EU ETS compliance with fuel strategy, chartering structures, and fleet renewal planning will materially reduce long-term exposure.